PROTECTION FOR A LIFETIME

Whole Life Insurance

Because Life Insurance is LOVE Insurance

“A man who dies without adequate life insurance should have to come back and see the mess he created.”

– Will Rogers

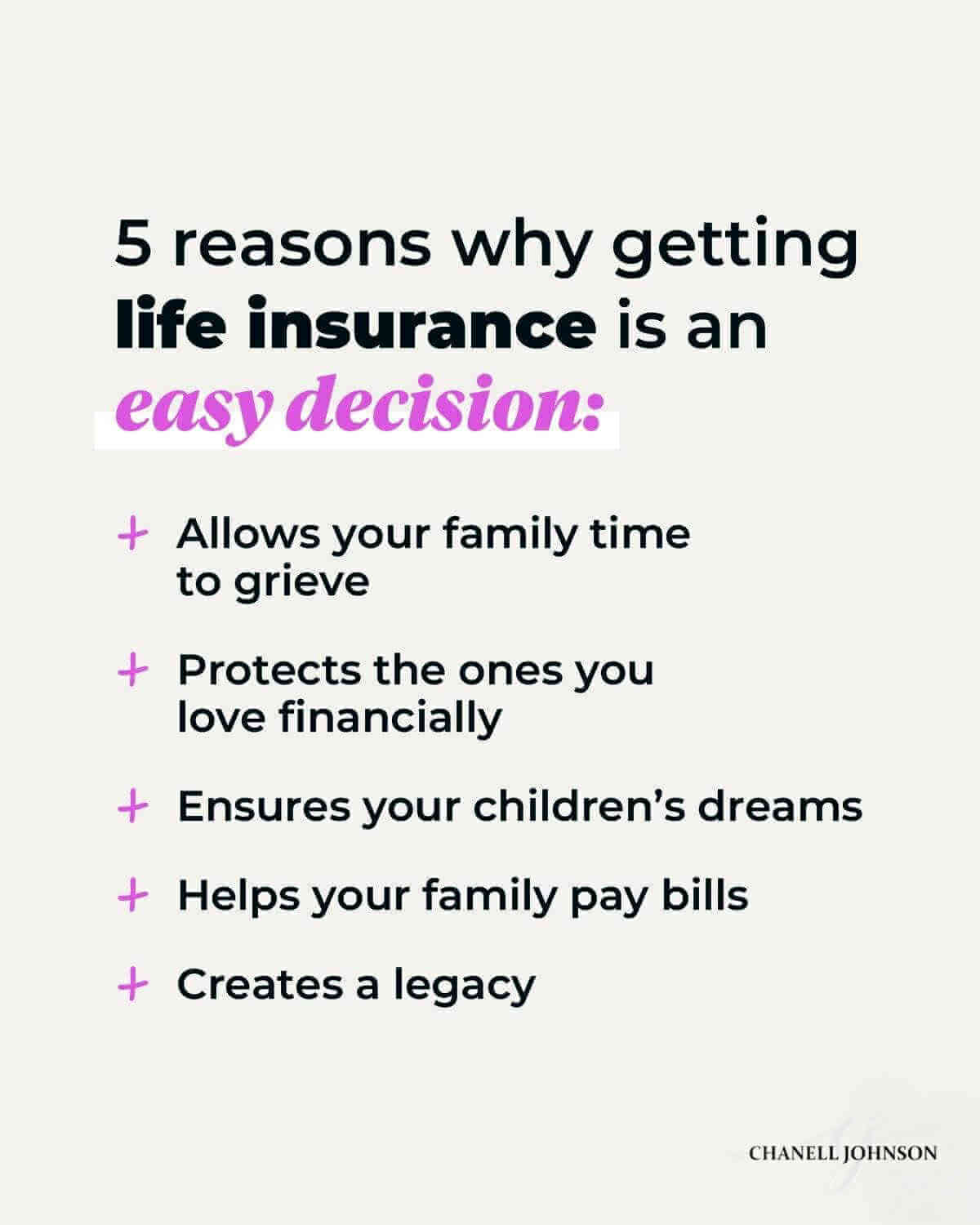

Why It’s SMART to Have Life Insurance

Understanding Whole Life Insurance

Whole life insurance provides guarantees from the insurance company that you won’t find in term or universal life insurance policies. Whole life offers protection that covers you for your entire life, or depending on the policy up to age 100 or 120 years old.

Premiums can be paid up until the death of the insured, or you can elect to pay a higher premium but pay for the policy over 10 years, 20 years or up to age 65 years old.

What is Whole Life

Whole Life insurance covers you, or other “insured person” throughout the life of the insured person. Whole life insurance contains a savings component in wich cash value may accumulate. Interest accrues on a tax-deferred basis. The death benefit is tax free.

Benefits of a Whole Life Policy

-

Covers you your entire life

-

Most policies have a level premium

-

Accumulates cash value

-

Cash value component typically earns a fixed rateof interest

-

Can take withdrawals or policy loans

-

Tax free death benefit

Disadvantages of Whole Life Insurance

-

Higher premium

-

Withdrawals and outstanding loan balances reduce death benefits

Types of Whole Life Insurance Policies

Ordinary (Straight Life) Insurance

Ordinary whole life insurance is the most common form of whole life policy. It requires the owner to pay a specified level premium every year until death, or age 100 or 120, depending on the policy.

Limited Pay Whole Life Insurance

Limited pay whole life insurance policies allow the policyholder to pay the premium on a 10 or 20-year payment schedule. At the end of the payment period, the policy is considered to be “paid up”. No additional premium payments are due, however, the insured is protected until death or age 100 or 120.

Single Premium Life Insurance

Single premium whole life policy requires the owner to pay a lump sum in return for life insurance protection that will extend throughout the insured’s lifetime.

Final Expense Life Insurance

Final Expense whole life insurance is a special life insurance policy for a specific need. These policies are designed to offset the costs of funeral, cremation and burial services.

Modified Whole Life Policy

Modified whole life insurance policies have lower premiums for the initial policy period, often three to five years. They increase to a higher premium at the end of the initial period. This type of policy gives you the opportunity to purchase a whole life policy with initial lower premiums which increase as your income increases.

Second-to-Die Whole Life Insurance

Second-to-Die whole life policies are often used in estate planning to provide liquidity at the death of the second spouse since this is typically when estate taxes for the couple would be due.

First-to-Die Whole Life Policy

Another type of joint life policy is First-to-Die whole life insurance. It covers two individuals, however the death benefit is paid on the passing of the first individual.

Children’s Whole Life Insurance

Children’s whole life insurance allows you to lock in a low annual premium and guarantees the opportunity to provide more coverage down the road, even if your child someday develops health issues or works in a high-risk occupation that would normally make it difficult to qualify for life insurance. Children’s whole life insurance is also an investment that accumulates cash value as your child grows up.

Cash Value Whole Life Insurance

Cash value whole life insurance, (Dividend Paying Life Insurance) is ordinary whole life policy or limited-pay policy that is designed to accumulate cash growth similar to saving money in a bank along with the death benefit.

Get The Ebook:

What I Wish I Knew Before I Became A Financial Educator

What I Wish I knew Before I Became A Financial Educator reveals the money mistakes I made along my own money journey.

Inside, I’ll share the impact of some of the mistakes I made and the money tips and tools I’ve learned to help me rebound from a low credit score and no financial security.

I’ll also share how applying a few key money hacks in your money plan can have long term benefits for you and your family. So you can stop worrying about money, debt and your financial future.

If you’ve spoken with me before you know I am very open about my journey. It’s far from perfect as I’m still learning and applying. In What I Wish I Knew Before I Became A Financial Educator you’ll learn from my mistakes so you and your children (if you have children) don’t have to repeat them.