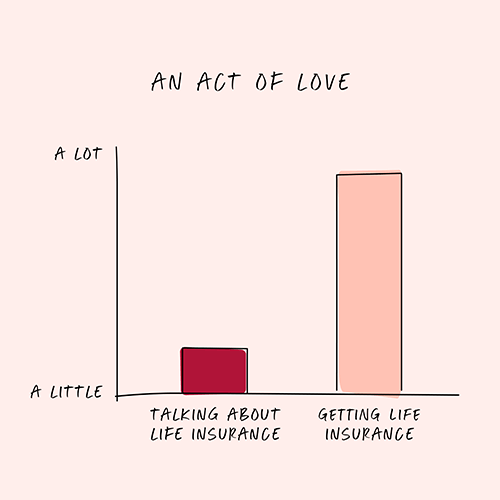

Life is Uncertain.

Life Insurance isn’t.

Why Life Insurance Should Be

a Part of Your Wealth Plan

Welcome to Chanell Helps Life Insurance HeadQuarters where we believe Life Insurance can help your family pay for your final expenses when you die, but also provides income replacement, mortgage protection, and a tax advantaged savings tool for large purchases and retirement.

“Life Insurance is the only tool that takes pennies and guarantees dollars”

– Ben Feldman

If you’re unsure whether life insurance is a good idea for you and your family I know you may be wondering the following:

- Which policy is right for you?

- How much will it cost?

- Can you afford life insurance?

- What type of insurance do you qualify for?

- Will it benefit you while you’re still alive?

I also know that because of those questions you are:

- Unclear what to do, so you do nothing

- Waiting until you have more money to get a policy

- Leaving your family unprotected or underprotected

- Taking a huge financial risk each day (tomorrow is not promised)

- Expecting to stay healthy and never get diagnosed with a medical condition that could make you ineligible for life insurance in the future.

- Not planning to die anytime soon, so you’ll get a policy later

I know this because I’ve been there too.

I also know this because over the years I’ve educated myself about life insurance and the many different ways it can come in handy in addition to a death benefit. I have policies in force to protect myself and my children, as well as be a source of future income.

I will share a ton of information here to help you understand in simple language how life insurance works and how it can benefit you and your family. You schedule a complimentary life insurance policy review or become a client.

Get The Savvy Business Owner’s Setup Guide:

Position Your Business for Success with

Tax Saving Strategies

Are you ready to build a rock-solid business foundation that will supercharge your growth and set you up for long-term success? This isn’t just another generic business guide – it’s your roadmap to creating a sustainable, thriving enterprise.

Inside you’ll find easy to understand steps you can take to ensure your business is built on a solid foundation like:

- Learn the best entity structure for your business to legally cut your tax bill.

- The Do’s and Don’ts of Business Expenses

- Documentation Best Practices

90% of business owners overpay their taxes because they fail to write-off expenses they already pay for. But not you. With the Savvy Business Owner’s Setup Guide you will be in the 10%.